Average US 30-year Mortgage Rate Drops to 6.65%, Offering Relief to Homebuyers

The average 30-year mortgage rate in the U.S. decreased to 6.65%, providing a positive shift for homebuyers during the busy spring season.

Overview

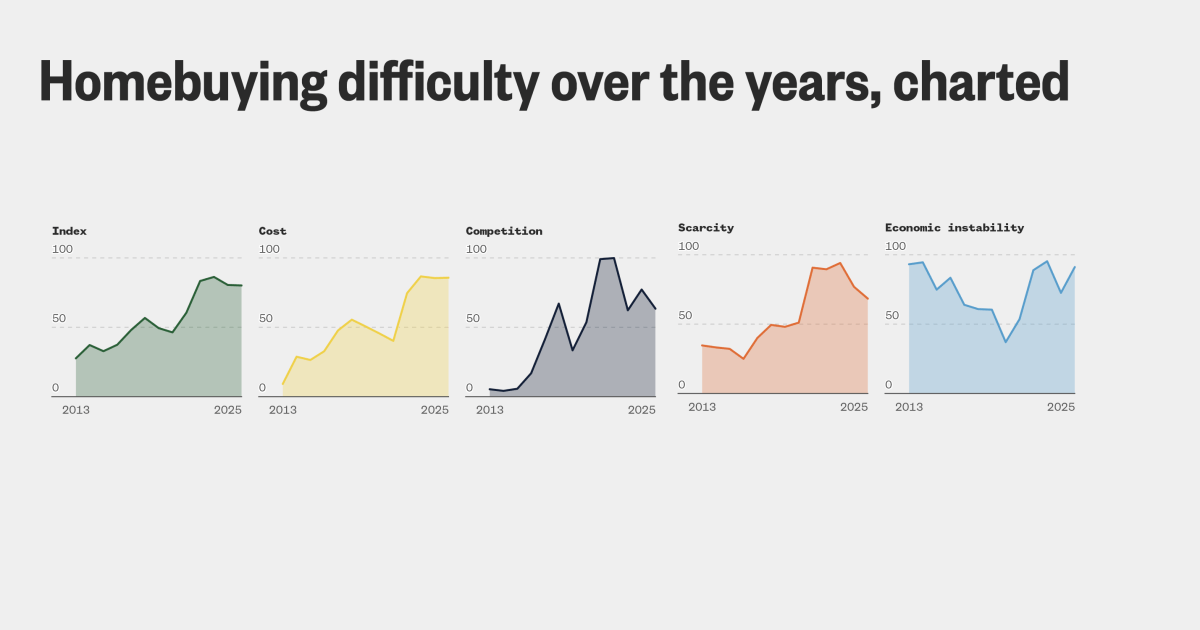

This week, the average rate on a 30-year mortgage in the U.S. fell slightly to 6.65%, a decline after two weeks of increases and a change from 6.79% a year ago. This trend is seen as encouraging for homebuyers amid a housing market slump. Meanwhile, 15-year fixed mortgage rates rose to 5.89%. Influenced by bond yields and economic factors, this slight mortgage rate decline comes as home sales could potentially rise with increased inventory and stable buying conditions. However, challenges remain as prices remain high—reflecting ongoing difficulty in the housing market.

Analysis

Analysis unavailable for this viewpoint.

Sources (4)

FAQ

No FAQs available for this story.

History

This story does not have any previous versions.