Nvidia's $5.5 Billion Loss Sparks Market Decline Amid New Export Controls

Nvidia faces a $5.5 billion charge due to new export regulations, contributing to significant stock declines across the semiconductor industry and broader markets.

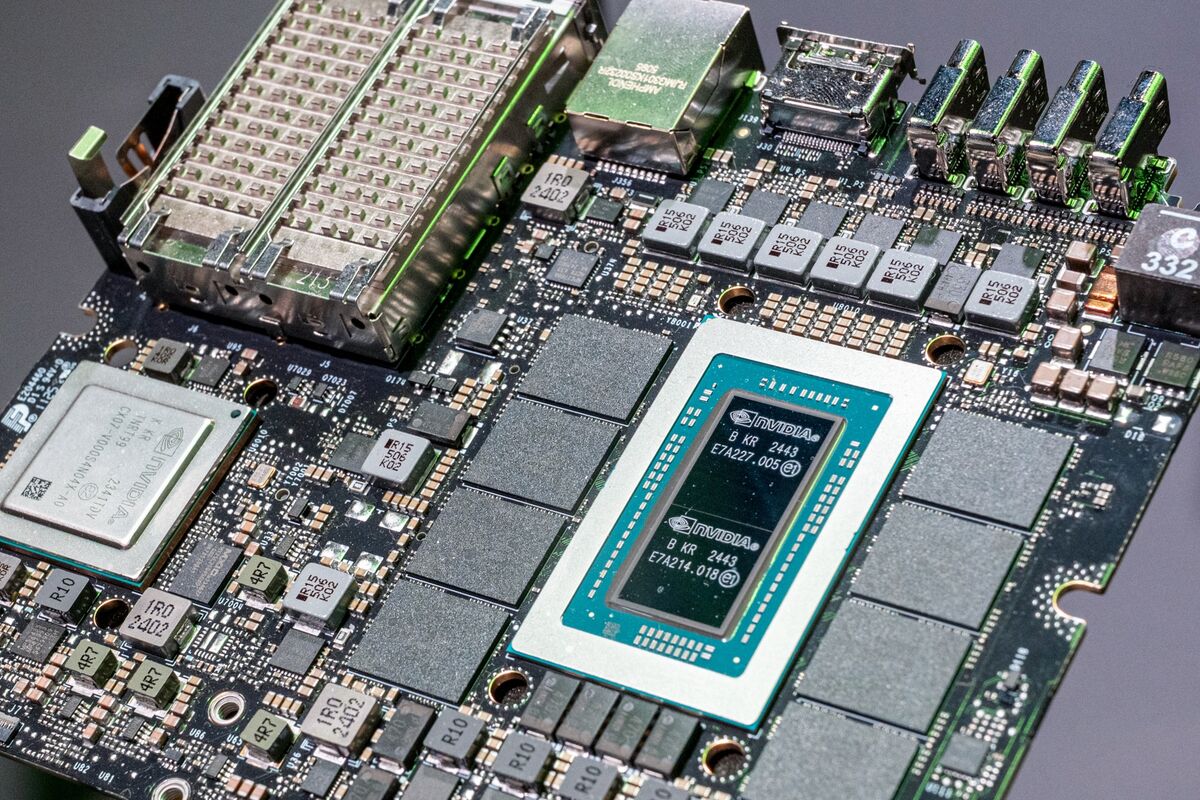

The sell-off, which has spread to semiconductor makers in Asia and Europe, comes after Nvidia said the Trump administration had restricted the sale of its H20 chip in China by means of new licence requirements.

US trade restriction on Nvidia sends markets tumbling again

The Guardian·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.Leans LeftThis outlet slightly leans left.

The Guardian·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.Leans LeftThis outlet slightly leans left.

Nvidia, now worth nearly $3 trillion thanks to widespread adoption of its chips by firms looking to boost their artificial intelligence capabilities, has become a bellwether for the broader market.

Markets sink after Nvidia announces $5.5 billion charge to comply with new Trump rule

NBC News·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

NBC News·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

Technology stocks led losses on Wednesday after Nvidia Corp. and Advanced Micro Devices Inc. said President Donald Trump ’s administration has curbed the export of its chips to China, while ASML Holding NV offered a disappointing earnings report.

Chipmakers Lead Tech Stock Rout as Trump Curbs Chips to China

Bloomberg·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

Bloomberg·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

The performance gap between Chinese chips and Nvidia’s is expected to widen, Wang said, because of “Nvidia’s superior ecosystem and manufacturing advantages,” even as DeepSeek’s rise demonstrates that high-performing AI models can be trained with lower-spec hardware.

Nvidia takes $5.5 billion hit as US clamps down on its China chips | Business

CNN·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.Leans LeftThis outlet slightly leans left.

CNN·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.Leans LeftThis outlet slightly leans left.

Nvidia said Monday it has commissioned more than one million square feet of manufacturing space to build and test its specialized Blackwell chips in Arizona and AI supercomputers in Texas — part of an investment the company said will produce up to half a trillion dollars of AI infrastructure in the next four years.

Nvidia shares fall after it says US controls on exports of AI chip will cost it $5.5B

ABC News·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

ABC News·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.Trade war concerns also were revived by a Trump administration announcement of an investigation into imports of critical minerals such as rare earths, which are used in smart phones, electric vehicles and many other products.

Asian shares fall as Nvidia, other tech companies are walloped by US controls on AI chips

Associated Press·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

Associated Press·3d·ReliableThis source consistently reports facts with minimal bias, demonstrating high-quality journalism and accuracy.CenterThis outlet is balanced or reflects centrist views.

Summary

Nvidia announced a $5.5 billion financial loss due to new export restrictions under the Trump administration, targeting its H20 AI chips. This news caused shares to drop 6%, contributing to a broader market downturn, with the Nasdaq falling 2% and the S&P 500 declining 1.1%. The charge represents costs associated with new licensing requirements aimed at preventing the potential use of these chips in Chinese supercomputers. AMD also warned of an $800 million charge due to similar regulations. This uncertainty has triggered a sell-off across the semiconductor sector, impacting companies globally and prompting concerns regarding future tech exports.

Perspectives

Nvidia's expected $5.5 billion financial hit due to new U.S. export controls on AI chips highlights the intensifying technology trade conflict between the U.S. and China.

The Trump administration's tighter controls are aimed at preventing advanced U.S. chips from bolstering China's military capabilities, indicating a strategic stance against China's rise in the AI market.

While some industry analysts express concern over the restrictions' impact on U.S. tech competitiveness, they recognize that the escalating trade tensions signal a likely continuation of such measures in the future.

FAQs

History

- 3d