Federal Reserve Cuts Interest Rates Again Amid Internal Divisions and Economic Concerns

The Federal Reserve has cut interest rates for the third consecutive time, facing dissent among officials and rising unemployment, while Trump calls for larger reductions.

Inside Scoop newsletter: The Fed hopes the third cut’s the charm

Federal Reserve cuts interest rates amid mixed economic data and divisions in its ranks

The US Fed delivers a third consecutive interest rate cut

Federal Reserve defers to Donald Trump by cutting interest rates by 25 points

Overview

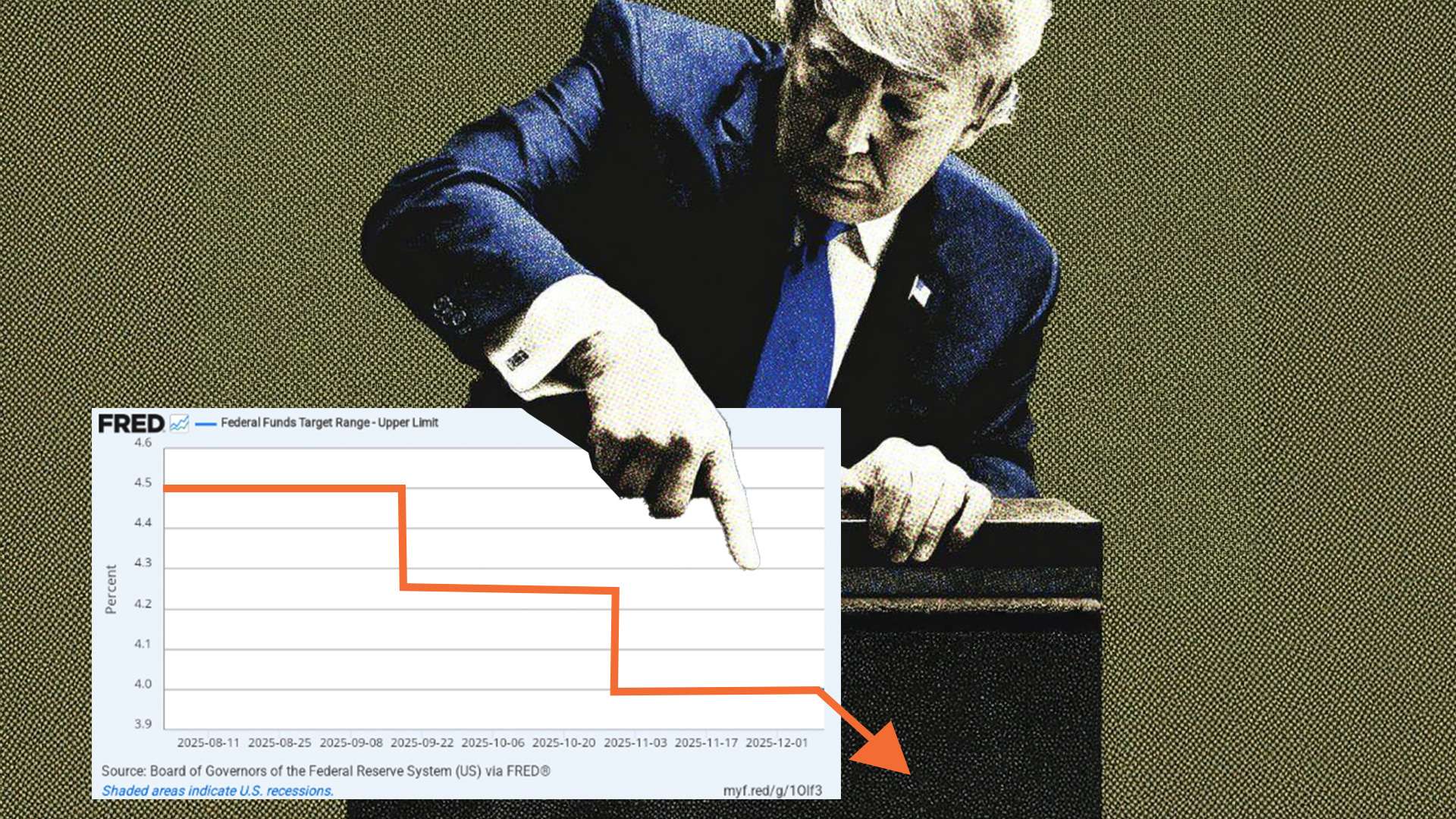

The Federal Reserve has reduced its key interest rate by a quarter-point for the third consecutive time, now approximately 3.6%.

Internal divisions emerged as three Fed officials dissented from the rate cut, the most dissent in six years, indicating contention within the board.

Job gains have sharply slowed, with the unemployment rate rising to 4.4%, influencing the Fed's decision to lower borrowing costs.

President Trump criticized the rate cut as insufficient, advocating for a larger reduction to stimulate the economy.

Policymakers are navigating a challenging economic landscape, with inflation expected to remain above the 2% target until 2028.

Analysis

Center-leaning sources cover the Federal Reserve's interest rate cut with a focus on the decision's complexities, internal divisions, and uncertain future implications. They present the Fed's rationale alongside dissenting opinions and expert analysis, highlighting challenges like data scarcity and the balancing act between inflation and employment goals. The reporting maintains an objective tone, providing a comprehensive overview of the economic and political context.

FAQ

The Federal Reserve cut interest rates three times consecutively due to slowing job gains, a rising unemployment rate (now 4.4%), and economic concerns that increased downside risks to employment, prompting them to lower borrowing costs to support the labor market and economy.

Three Federal Reserve officials dissented from the most recent quarter-point rate cut, marking the highest dissent in six years, reflecting significant internal divisions and contention within the Fed about the policy direction.

President Trump criticized the Federal Reserve's rate cuts as insufficient and advocated for larger reductions to better stimulate the economy.

Lower interest rates reduce borrowing costs, making it cheaper for consumers and businesses to take loans and manage debt. However, bank deposit rates typically decrease, meaning savers may earn slightly less interest on their accounts.

The Federal Reserve expects inflation to remain above its 2% target until 2028 and is focused on supporting maximum employment, though recent economic data shows slowing job gains and elevated uncertainty.